Compensation Guide

New Trends in GTM Roles

The past few years have brought unprecedented change to GTM teams. We’ve never seen so many new roles emerge so quickly. Companies are creating positions like Head of AI Enablement, AI Sales Strategist, GTM Automation Lead on the Operations team, RevOps AI Integrator on the Revenue Operations team, and AI Forward Deployment Engineer on the Customer Success team.

Each of these roles blends traditional GTM responsibilities with AI strategy, technical execution, and process optimization, helping teams work faster and smarter. These positions are appearing across startups and high-growth companies, reshaping team structures, redefining the skills that matter, and changing how performance is measured. At the same time, compensation and promotion expectations are shifting to reward AI fluency, measurable output, and strategic impact.

Several patterns are emerging

AI is now part of nearly every GTM role, entry-level paths are evolving, fractional leadership is increasingly common, and compensation is increasingly tied to measurable output and AI skills. In this guide, we outline the key trends shaping GTM hiring today.

Head of AI Enablement

AI Sales Strategist

GTM Automation Lead

RevOps AI Integrator

AI Forward Deployment Engineer

AI is now embedded in nearly every GTM role. It is not replacing teams but redefining what success looks like. Candidates who can use AI for outreach, analytics, personalization, forecasting, and content creation are commanding higher pay. SDRs with prompt engineering skills or RevOps talent experienced in AI workflows are especially in demand. Companies are also providing training and access to AI tools for existing employees to help them stay competitive.

As a result, top performers are now defined not only by traditional GTM skills but also by how effectively they leverage AI in their daily work.

The AI Layer in Every GTM Role

1

High Demand

SDRs with prompt engineering skills

High Demand

RevOps talent experienced in AI workflows

We are seeing more new roles created than ever before. AI-focused positions like Head of AI Enablement, AI Sales Strategist, GTM Automation Lead on the Operations team, RevOps AI Integrator on the Revenue Operations team, and AI Forward Deployment Engineer on the Customer Success team are emerging rapidly. Compensation for these roles is still evolving but is rising quickly due to the scarcity of qualified talent. These roles combine technical fluency, strategic thinking, and GTM expertise in ways that traditional roles do not.

The Rise of AI-Native GTM Titles

2

Competitive Advantage

Companies that adopt these positions early gain a competitive advantage by building AI-powered GTM teams faster.

Many Seed to Series A companies are hiring fractional Heads of Sales, Marketing, or Customer Success instead of full-time executives. These fractional hires help build frameworks, define processes, and set strategies before a full-time hire is feasible. Compensation usually comes in the form of part-time retainers plus success-based bonuses, allowing startups to access executive-level expertise without overcommitting. Fractional leaders provide playbooks, frameworks, and guidance for the next full-time hire, accelerating team development. This approach also gives startups flexibility to scale GTM functions efficiently as priorities evolve.

From First Hire to Fractional Hire

3

Traditional entry-level roles are evolving faster than ever. SDRs, marketing coordinators, and CS associates are now expected to be fluent in AI tools from day one, using them for prospecting, analytics, reporting, and content creation. Companies are paying a premium for this AI-native early-career talent, and new titles such as Sales Development Analyst or AI Marketing Coordinator are replacing classic entry-level roles. This change is directly tied to the decline of traditional paths: as automation takes over repetitive tasks, early-career hires must bring technical and AI skills to add real value from day one. Candidates and hiring managers alike are rethinking how skills, experience, and potential are evaluated for the next generation of GTM professionals.

From Entry-Level to AI-Ready

4

Role Evolution

At the same time, automation and AI are eliminating many traditional entry-level GTM tasks. Roles that once focused on repetitive outreach, reporting, or coordination are shrinking, which is why AI-ready positions are emerging in their place. Companies are hiring fewer but more technical early-career professionals who can handle complex systems and AI tools. Compensation for classic entry-level roles has flattened, but high performers in leaner, more technical teams often experience faster promotion. Candidates can access these positions by connecting with founders raising capital, working with an agency like Betts or joining early-stage teams that prioritize AI fluency and technical skill.

The Vanishing Entry-Level Path

5

Generative AI and other advanced tools are reshaping performance expectations. SDRs, AEs, CSMs, and marketing associates are increasingly measured on how effectively they leverage AI for prospecting, personalization, content creation, and analytics. Companies tie variable compensation and bonuses directly to AI-driven output and efficiency. Top candidates are attracted not only by pay but also by rapid promotion paths for those who excel in AI-augmented roles.

Output-Based Compensation in AI-Enabled GTM Roles

6

The New Standard

Results-driven GTM professionals who combine traditional skills with AI fluency are rewarded more consistently.

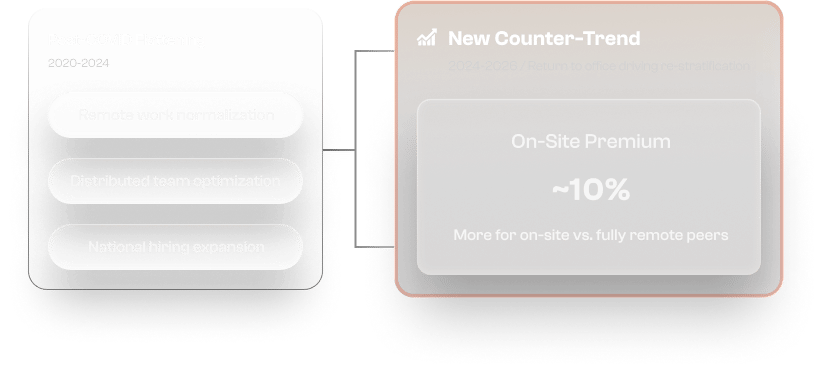

Over the last four years since COVID, sales compensation has flattened significantly across geographies, with remote work driving a broad normalization of pay between historically high-cost and low-cost markets. Location-based differentials narrowed as companies optimized for distributed teams and expanded national hiring, effectively arbitraging talent without paying coastal premiums. However, a new counter-trend is now emerging: as companies push for in-office or hybrid execution, they are beginning to reintroduce geographic and presence-based premiums, often paying ~10% more for employees willing to work on-site versus fully remote peers. This shift is actively destabilizing the post-COVID pay equilibrium, signaling a return to compensation stratification driven not just by role and performance, but by physical proximity, speed of execution, and cultural leverage inside the organization.

Reintroduction of Geographic and Presence-Based Premiums

7

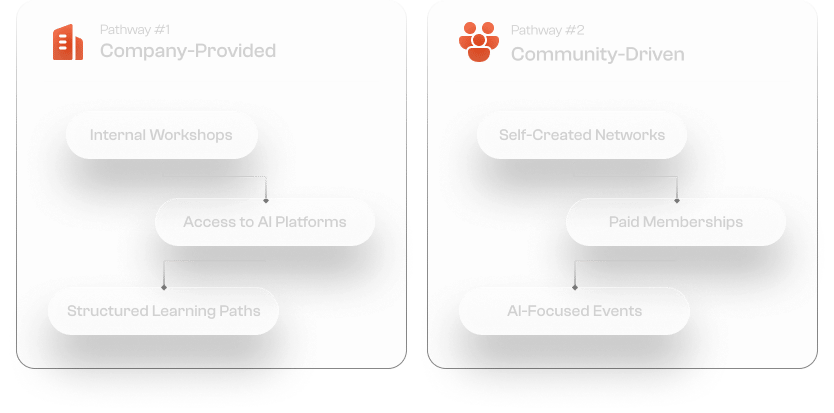

AI fluency is now critical at all levels of GTM. Early-career and mid-career professionals must learn to combine AI tools with core sales, marketing, and customer success capabilities. Companies are providing internal workshops, access to AI platforms, and structured learning paths to help employees acquire these skills.

At the same time, professionals are increasingly turning to communities to stay ahead. Whether through self-created networks of former colleagues and peers, paid memberships like Pavilion, or attendance at AI-focused events even large gatherings like Dreamforce, these communities provide practical insights on which AI tools work, best practices for implementation, and ways to integrate AI into daily GTM workflows. Sharing knowledge in peer groups accelerates learning, helps avoid common pitfalls, and allows GTM professionals to benchmark their skills against industry peers. In today’s environment, haves who actively use AI and participate in these communities are far ahead of have nots who rely solely on traditional methods. Engaging in learning opportunities and communities is becoming a critical part of developing AI fluency and maintaining a competitive edge in AI-enabled GTM roles.

Building AI Fluency Through Learning and Communities

8

As AI reshapes GTM roles, traditional compensation models are being questioned. Will we see the end of OTE as we know it? Three possible approaches are emerging.

Rethinking Compensation in the Age of AI

9

Variable elasticity based on AI understanding of sales motion execution

AI can monitor deal velocity, pipeline health, and individual contribution to provide more dynamic and precise incentives.

Team Variable

In a world where multiple people are needed to close, implement, and manage accounts, tying compensation to team performance creates a fairer and more collaborative model.

Things stay the same

Some companies may choose to maintain traditional OTE structures, at least in the short term, while observing how AI impacts productivity and role design.

The Signal

These approaches signal that compensation is evolving to reflect AI-driven performance, collaboration, and measurable impact in GTM teams.

Below we outline our target compensation recommendations and the trends behind them. Target compensation is the Market Rate. It's the benchmark that companies must strive to meet if they want to have an extensive candidate pool and hire rapidly to meet their growth goal.

Falling below this benchmark may result in prolonged hiring timelines and a more limited candidate pool. Conversely, exceeding the benchmark significantly may expand the candidate pool, but returns on investment diminish as compensation moves further beyond the market rate. Striking the right balance is key for achieving an effective and efficient hiring strategy.

2026 Target Compensation

Sales

The below framework establishes a baseline with $100,000 base salary and an On-Target Earnings (OTE) of $200,000 for the average SaaS seller.

Target Compensation

For LIVE Compensation Insights, please see our Comp Engine

All compensation is listed in thousands of $USD, all timezones are US timezones.

SDRs, AEs and EAEs

Compensation by Location

For LIVE Compensation Insights, please see our Comp Engine

All compensation is listed in thousands of $USD, all timezones are US timezones.

Sales Operations

Sales Operations, Revenue Operations, and Sales Engineers - Compensation by Location

For LIVE Compensation Insights, please see our Comp Engine

All compensation is listed in thousands of $USD, all timezones are US timezones.

Sales Leadership

Sales and SDR Managers - Compensation by Location

Target Compensation

For LIVE Compensation Insights, please see our Comp Engine

All compensation is listed in thousands of $USD, all timezones are US timezones.

Customer Success

Customer Success and Account Management - Compensation by Location

For LIVE Compensation Insights, please see our Comp Engine

All compensation is listed in thousands of $USD, all timezones are US timezones.

Marketing

Content, Demand Generation, Product and Event Marketing - Compensation by Location

This would create far more opportunities for recent grads than they have today. Companies will need to treat this as a long term investment rather than a quick ROI. That can be a hard mindset shift for tech companies that move fast and expect immediate results.

Comp Engine

While the Compensation Guide is updated every few months, Comp Engine delivers fresh data every few minutes—keeping you ahead of the curve. Whether you're a hiring manager optimizing offer packages or a job seeker looking for fair market value, Comp Engine empowers you to make smarter, more competitive decisions to attract and retain top talent.

Loved our Compensation Guide? Take it a step further with Comp Engine, where you can access real-time compensation insights for Sales, Marketing, and Customer Success based on actual placements.

Recruitment as a Service

Betts' recruiter subscription model (RaaS) changes the future of recruiting with unlimited hires and full recruiter support. Betts connects the most extraordinary go-to-market talent with the most innovative companies in the world.