2023 Edition

EQUITY

Say, you've just gotten a new job—congrats!—but when staring at your offer letter, you're suddenly overwhelmed trying to make sense of your new base salary, PTO, health insurance, and, crucially—equity. Before you start scratching your head and frantically googling "WTF is equity," don't worry; we got you covered. Here, we'll cover all the basics—from vesting to cliffs to what you should expect in terms of equity—and have you on the way to being an equity expert in no time.

Intro

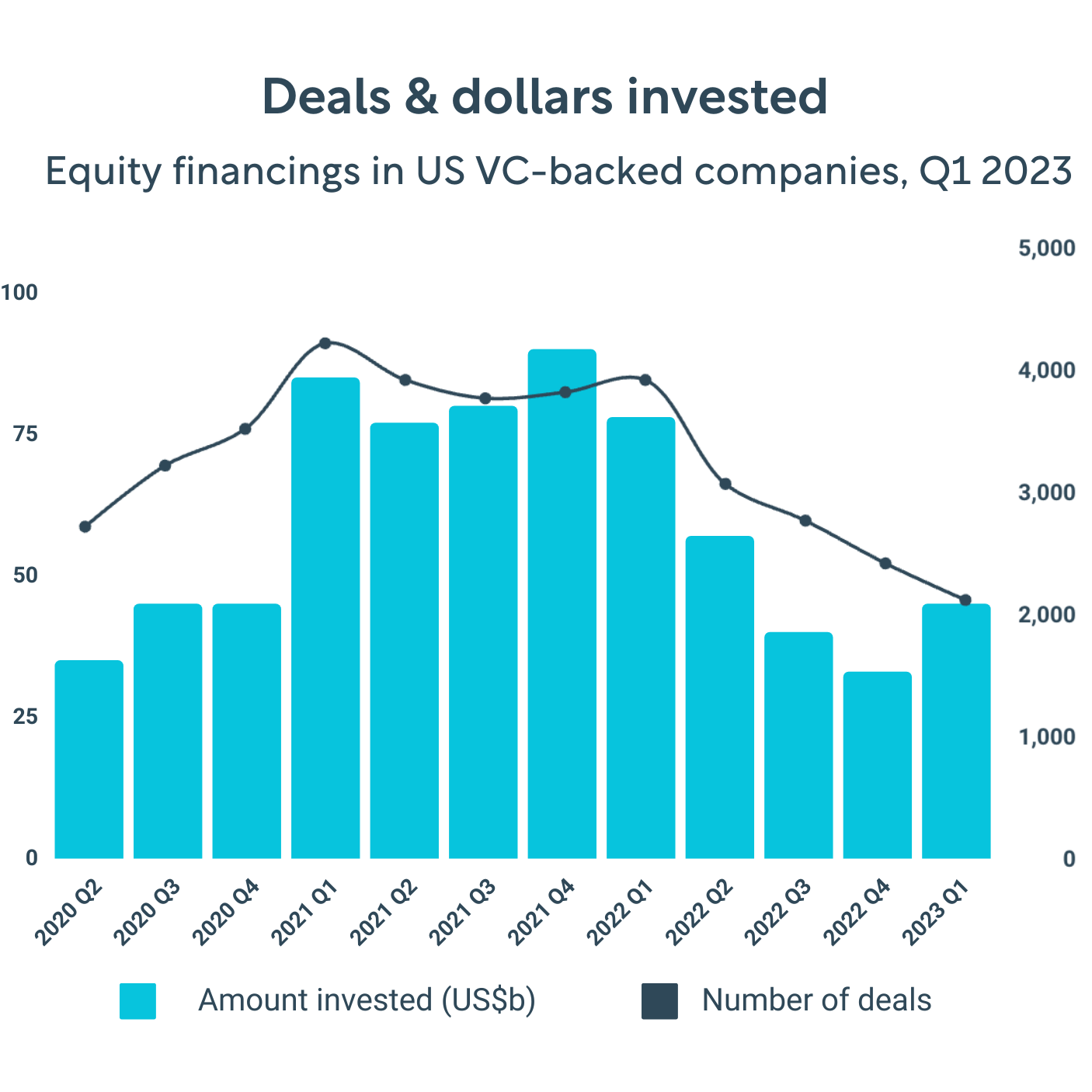

2023 has been a doozy for tech. Media coverage of big tech layoffs got a lot of airtime, giving the impression that hiring had cooled in this once-hot sector, which might make you think that equity compensation is similarly on ice. If you are part of a startup or thinking about joining one, equity remains a vital currency in that world. Here, we give you the inside scoop on all things equity so you can better understand the lay of the startup land.

Despite the shrinking of big tech roles, the market across the United States has actually been heating up. This past April, employers listed more than 300,000 job postings for tech positions, signaling that demand for tech talent continues to rise. And with the tech unemployment rate at 2.3%, what’s clear is that the tech job market is more complex than media coverage would have you believe.

Research by Betts Recruiting indicates that a mixture of factors will translate to a market that will remain competitive. Tech startups will continue struggling to hire and retain top talent even with job growth in some sectors slowed down.

The Lay of the Land

Despite market volatility and inflation, startups have largely stuck to their playbooks concerning granting employees equity options. According to a recent report from Lightspeed Venture Partners about 2023 VC trends, equity approaches remain unchanged despite market instability. The majority of VC-backed companies plan to keep their equity strategy the same.

- 64% are unlikely to reprice options

- 69% are unlikely to give additional grants to account for a lower valuation

Executive-level leadership roles, like C-suite, VPs, and Directors—are still in high demand for tech startups, so incentivizing them is vital. Equity is still a significant component of startup comp—with stock options used to attract and retain top talent. Despite the roller coaster ride of the last six months, equity is still on the table, which means you want to understand the lay of the options-land as well as you can.

Back to Basics

Let's dive right into it—equity options allow an employee to buy a specific number of shares at a preset price. Companies often offer equity options as part of the comp plan to incentivize you to help the business succeed and be rewarded for your efforts. Think of it as owning a part of the company.

However, before you start picturing that new apartment or fancy sports car, there's a catch. These options can only be purchased at a discounted price (or strike price) after a specific timeframe known as a vesting period has passed. But we'll get into that later. For now, we'll break down the essential bits so you can understand your equity offer. Please remember that this is not for tax purposes—it's a general guide—every situation or offer is unique..

Before you read on, there is no need to worry about understanding equity terms because we have you covered from 'strike price' to 'vesting.' You can nix the frantic googling; all the definitions you'll need are in our Equity Glossary. Welcome to the wonderful world of equity.

What is Vesting

Vesting is the process of earning the value of your equity options over time. Companies use the vesting method to encourage you to invest your time and contribute to the company's success for at least several years.

Vesting typically happens on a time-based schedule outlined in your stock option agreement. The vesting start date should be listed on your contract. Most companies have a four-year-long vesting schedule, typically starting with a standard one-year "cliff." A cliff is a period of time that must elapse before you can get any of your vested options. Like a fine wine, the longer you stay at the company, the more valuable your options become and the greater your reward. It's an incentive to stick around and excel because the harder you (and everyone else) work, the better the company will do, which will likely benefit the size of your eventual payout over time.

How Do You Vest?

Your offer letter should explain your specific vesting schedule breakdown. Typically, it will be broken down over a few years, for example, 1,200 options with a one-year cliff over four years. If you leave before that year ends, all options become forfeit, expire, and return to the company after thirty days.

Once the one-year cliff has passed, however, that doesn't mean you can buy all of your options—only a set number, otherwise known as the vested amount. If, for example, you have a four-year vesting period, after your first year has passed, you can exercise ¼ of your options. Then, it will be broken down by month, giving you a little more each month until finally, after four years, you will, theoretically, be the proud owner of your entire equity option grant. If you're lucky enough to receive more options as the years go by, they will also be dependent on their unique vesting schedule.

Here's an example that will hopefully make a little more sense.

Margot is a lucky new employee at Company Inc., and as the newest SDR, she's been given an option grant with 1,200 options over a vesting schedule of four years with a one-year cliff. Exactly one year after her start date, she reaches her cliff, and ¼ of her equity—300 options—vest. After that one-year cliff, there are three years, or 36 months, left till she is fully vested. After the cliff, options vest monthly, so 1/36 of the granted options will vest with each passing month until Margot hits her 4-year mark with Company Inc., at which time she can officially purchase all 1,200 of her options at the original strike price.

However, if she decides to leave the company after two years, she can exercise ½ of the options awarded to her at the original strike price. With that in mind, she can purchase at that strike price or walk away from the options. And again, any unvested options will be returned to the company and distributed among the company option pool.

Meet Margot

Equity for Executives

Equity compensation is an integral part of the startup landscape. It is a way to attract and incentivize executives by giving them shares in company ownership, though it can take some work to figure out how to parse shares.

The exit timeline, contribution level, degree of commitment, and company valuation at the time of equity distribution all impact the percentage of equity allocated to an executive. The series stage is another factor influencing equity compensation—the later the stage, the less equity given.

The amount of equity you should provide depends mainly on the position and seniority level of the recipient. A CFO or executive team member might receive up to 15% or more, while entry-level positions could get 0.01%-0.05%. Someone bringing in new investors may receive more equity than an engineer with similar skills and experience, as their contributions will be more tangible.

Equity by Role

Executive Equity Checklist

Equity tranches look different depending on what series stage the startup is in. Earlier-stage companies have higher risk and correspondingly higher rewards. Because earlier-stage startups tend to be less organized than the later stage, the checklist below is from the perspective of early-stage equity options offered when it’s the Wilder West.

Having a successful exit depends on many things, and while you can’t control many of them, you can ensure that the contract you agree to has your best interests in mind. Taking care of a few key details of the options or restricted stock offer at the negotiation stage can be the difference between ka-ching and cringe.

Last thing—make sure the company has Board Approval

Tax Planning

Don’t ask us, we’re recruiters—but if you’re taking a new job as an executive, consult a tax attorney about your equity agreement. We have seen too many executives end up in a place not that much better when their company exited as they didn’t do the proper planning or negotiating upfront.

Negotiation

When negotiating your equity, here are some key things to keep in mind:

- Percentage is important (see above)

- Vesting schedule—four years is the the norm, but you can try for better

Change of control—the most underrated and most important factors in your equity negotiation are:

- Early Sale—What happens if the company sells tomorrow and only a ⅓ of your options have vested at the time of the early sale? Find out.

- Double trigger—As an executive, you should be negotiating for a double trigger at the very least. If the company has a change in control, sells, or goes public, and you get laid off as a result, all your options vest.

- Single trigger—ALL your options vest if there is a change of control—this is the mother of all negotiated equity items.

- Getting on the Board and obtaining a board seat.

- Additional option grants, milestones, or tenure. Milestones always get you more credit.

Make it Official

New hires need to review and sign the necessary paperwork to ensure they have the legal right to equity, not a promise of future equity.

- Get a copy of the Stock Option Grant or Restricted Stock Purchase Agreement—before signing the offer letter.

- Review terms with legal counsel and negotiate any issues.

- Ask when the Board will officially make the equity grant post-hire—this should not take more than a couple of months.

- Follow up after hire to be sure the grant is made promptly and the documents are signed.

- When granted, compare the terms of the equity grant to ensure they match what was agreed to at the time of the offer letter.

Calculations to Consider

Don’t get happy ears here, look at multiple and other exits in your industry to understand real value. You want to understand:

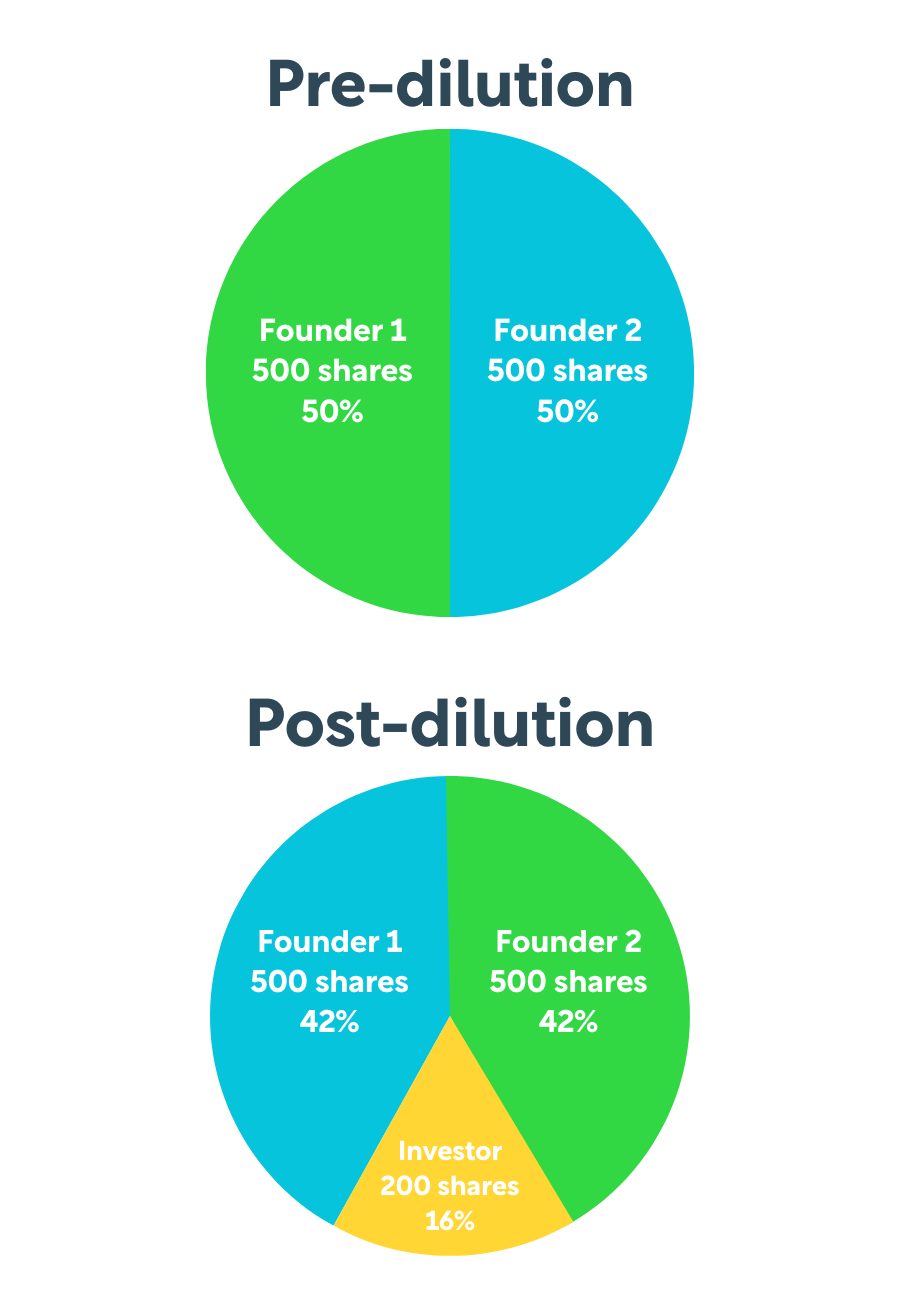

- Round-by-round dilution if goals are hit

- Your value at exit based on proposed dilution and exit at half estimated price

- Your value if sold at next funding round versus planned exit

Percentage Ownership

Mary Russell advises individuals on their startup equity offers including their percentage ownership negotiations. She notes: "Silicon Valley lore holds that anyone who joins a startup that hits big will become rich. But if they don’t negotiate for the correct number of shares at hire, they cannot expect that the value of their equity at acquisition or IPO will be impressive." The earlier the stage of the company, the more equity would be needed at hire to help mitigate and balance that risk. Don’t assume you’ll be “taken care of” with additional grants in the future. Russell recommends:

- Negotiate for enough shares upfront to balance the risk of joining the company. Confer with colleagues and advisors about what that tranche might be.

- Target standard time-based vesting—not milestone or performance-based vesting.

- Your equity will become diluted. Negotiate for enough shares to cover that expectation.

Growth Plans and Next Round Goals

You want to understand what steps the company is taking to achieve its growth trajectory.

- What amount of funding are they looking to raise next?

- What markers do they need to hit to make a compelling case for their next round of financing?

Companies Exit Plan and Timeframe

The greater the time, the greater the risk—and the more work for you. You want to be crystal clear on what the exit plan is and how the company plans to get there. Here are some of the BIG questions you want to understand:

- What is the exit goal — IPO? Strategic buyer? Private equity?

- What is the exit plan — how does the company plan on achieving their exit goals?

- How long until the exit?

Competitor’s Multiples

Is the porridge too hot? Too cold? Just right? It’s critical to understand if the company is overvalued or undervalued based on the market. While you will never be 100% spot on accurate, getting as close as possible to the true valuation based on your own research and sleuthing gives you some ammunition to chat with the CEO.

Companies Current Valuation

It is essential that you have a strong understanding of what the company’s current valuation is and how their current cap table looks. Here are some key components to be aware of:

- Last funding round amount

- Current valuation

- Shares outstanding

- Cap Table

- Investors

- Type of options being offered to you

- Liquidation preferences

Here is our Executive checklist to ensure you get the most out of your equity negotiations:

Here is our Executive checklist to ensure you get the most out of your equity negotiations:

Companies Current Valuation

It is essential that you have a strong understanding of what the company’s current valuation is and how their current cap table looks. Here are some key components to be aware of:

- Last funding round amount

- Current valuation

- Shares outstanding

- Cap Table

- Investors

- Type of options being offered to you

- Liquidation preferences

Competitor’s Multiples

Is the porridge too hot? Too cold? Just right? It’s critical to understand if the company is overvalued or undervalued based on the market. While you will never be 100% spot on accurate, getting as close as possible to the true valuation based on your own research and sleuthing gives you some ammunition to chat with the CEO.

Companies Exit Plan and Timeframe

The greater the time, the greater the risk—and the more work for you. You want to be crystal clear on what the exit plan is and how the company plans to get there. Here are some of the BIG questions you want to understand:

- What is the exit goal — IPO? Strategic buyer? Private equity?

- What is the exit plan — how does the company plan on achieving their exit goals?

- How long until the exit?

Growth Plans and Next Round Goals

You want to understand what steps the company is taking to achieve its growth trajectory.

- What amount of funding are they looking to raise next?

- What markers do they need to hit to make a compelling case for their next round of financing?

Percentage Ownership

Mary Russell advises individuals on their startup equity offers including their percentage ownership negotiations. She notes: "Silicon Valley lore holds that anyone who joins a startup that hits big will become rich. But if they don’t negotiate for the correct number of shares at hire, they cannot expect that the value of their equity at acquisition or IPO will be impressive." The earlier the stage of the company, the more equity would be needed at hire to help mitigate and balance that risk. Don’t assume you’ll be “taken care of” with additional grants in the future. Russell recommends:

- Negotiate for enough shares upfront to balance the risk of joining the company. Confer with colleagues and advisors about what that tranche might be.

- Target standard time-based vesting—not milestone or performance-based vesting.

- Your equity will become diluted. Negotiate for enough shares to cover that expectation.

Calculations to Consider

Don’t get happy ears here, look at multiple and other exits in your industry to understand real value. You want to understand:

- Round-by-round dilution if goals are hit

- Your value at exit based on proposed dilution and exit at half estimated price

- Your value if sold at next funding round versus planned exit

Make it Official

New hires need to review and sign the necessary paperwork to ensure they have the legal right to equity, not a promise of future equity.

- Get a copy of the Stock Option Grant or Restricted Stock Purchase Agreement—before signing the offer letter.

- Review terms with legal counsel and negotiate any issues.

- Ask when the Board will officially make the equity grant post-hire—this should not take more than a couple of months.

- Follow up after hire to be sure the grant is made promptly and the documents are signed.

- When granted, compare the terms of the equity grant to ensure they match what was agreed to at the time of the offer letter.

Negotiation

When negotiating your equity, here are some key things to keep in mind:

- Percentage is important (see above)

- Vesting schedule—four years is the the norm, but you can try for better

Change of control—the most underrated and most important factors in your equity negotiation are:

- Early Sale—What happens if the company sells tomorrow and only a ⅓ of your options have vested at the time of the early sale? Find out.

- Double trigger—As an executive, you should be negotiating for a double trigger at the very least. If the company has a change in control, sells, or goes public, and you get laid off as a result, all your options vest.

- Single trigger—ALL your options vest if there is a change of control—this is the mother of all negotiated equity items.

- Getting on the Board and obtaining a board seat.

- Additional option grants, milestones, or tenure. Milestones always get you more credit.

Tax Planning

Don’t ask us, we’re recruiters—but if you’re taking a new job as an executive, consult a tax attorney about your equity agreement. We have seen too many executives end up in a place not that much better when their company exited as they didn’t do the proper planning or negotiating upfront.

Last thing—make sure the company has Board Approval.

Equity Compensation by Role

Equity by Role

Now that we’ve covered what equity is and how to make sense of it, let's make sure that you’re getting the compensation you deserve by looking at average equity compensation by role. So we’ve broken down what average equity compensation as a % of the total company for our sales roles for Seed through Series B companies based on data from our thousands of placements over the last year.

Interestingly, while compensation has increased dramatically over the past couple of years, equity for the most part is growing at a much slower pace. With one big exception, which is Senior Leaders and C-levels getting up to 30%+ more equity in Seed and Series A.

Different risks and rewards exist depending on what stage in the startup lifecycle you join a company— it's essential to understand the risk and rewards. If you're considering taking a job with a startup that just raised a Seed round, know that they are at the beginning of their growth journey, which means there is a high risk that those companies will not have a successful exit. The rule of thumb is that 10% of startups will have a successful exit. With a Seed stage company, what you get is high risk—but the most significant amount of equity for that risk. You'll see in the table below that Seed round companies give out 4-5X the options versus a Series B company—and that's how you hit a 100X return.

While a Seed series company only has a 1 in 10 chance of a successful exit, a Series B company has a 1 in 3 chance of a successful exit—you're getting fewer options but have a much higher likelihood of getting to the exit.

The game looks considerably different if you join a Series C Company. There is a far greater chance of a successful exit—8 out of 10—but your average payout will be 2-10X versus the potential of 100X+ from a Seed series.

Here's why: there won't be enough equity available to hand out as sizable tranches of equity options by Series C, and the actual exit value is relatively easy to predict, so companies usually give out options as a multiple of annual on target earnings, or OTE, with a strike price similar to that of the last valuation price per share. OTE represents the total amount of money one should expect to make in a year if quotas are hit. For example, if a sales executive's annual salary is $100k, with a variable bonus amount of $100k, they will only receive $200k if they hit 100% of their quota.

Here's where it can get confusing— but please keep in mind that not every company doles out equity this way—if Margot gets a role at a Series C company as a CRO with an annual OTE of $500k, then her equity compensation would be two multiplied by her OTE to receive the value of what her shares should be at the end of the four-year vest. This heavily depends on company value, the strategic nature of roles, growth potential, and more, but it's a good baseline for Margot to understand her importance to the company.

Assuming the company Margot joins is a typical Silicon Valley start-up, then it should have about 10 million shares with 1.5 to 2 million reserved for the Optional Pool. In other words, those 1.5 to 2 million shares are reserved for the employees when they join the company or as a reward for hard work. Something to keep in mind is that your percentage of shares goes down as the company raises money. While you will theoretically be making more money as the company raises more funding rounds, your percentage of total shares will be smaller.

The vesting period is based on the most typical schedule—the one-year cliff and four-year vesting timeframe that Margot already experienced in the example above.

Feel free to enter your equity information, into our Equity Calculator to see what your equity could potentially earn in the long run!

As the company grows, the percentage of ownership gets diluted as more people join the organization. Think of it as a bottle of wine—the more people sharing the bottle, the less vino that ultimately ends up in your cup. That’s not to say that you won’t get any if you join a Series C company, but you won’t get as much as if you were to join during the Seed round.

If your company goes public, on the other hand, you will no longer get a percentage of the company— instead, you’ll get a specific dollar value of your base salary or OTE. Typically, you will receive around 10% as an initial option grant. Afterward, you’ll be able to buy more equity through a stock buyback program through your payroll at a discount. For example, if you make $1,000/month, you could spend $200 on stock at a 20% discount. What a way to invest!

Two vital elements come into play when dealing with the amount of equity your company will offer you: your title and the round of funding your company is in. As the organization goes through funding, the amount of equity you receive can be diluted due to more team members joining.

But don’t be too worried—it’s a natural progression of growth and doesn’t mean you’ll miss out on more money in the long run. The more your company grows, the more money in the bank—and the more money you can ultimately earn.

Margot's Options

Let’s break down the information to be more user-friendly.

Margot is joining Company Inc. as an SDR during Series A. That means that she would be receiving 0.05-0.10% of shares at the time of signing on. Please keep in mind that this amount can change based on your location, experience, and the actual title that you sign on with. As an SDR, Margot receives a different amount than if she were a VP of Sales or an Account Manager. If Margot reaches her dream of becoming a VP of Sales in five years, she would expect to make a $175,000 annual salary with an equity offering of 35,000 options.

A good breakdown to make sense of it all is as follows: “Title” | “series” | “location” = x amount. Therefore, an SDR at a company in Series A should look at making 0.10% equity using this equation: (salary X multiplier)/ company value X # of diluted options outstanding = amount of equity.

Don’t worry if you’re confused! That’s why we’re here to make sense of it all.

Equity Calculator

From a company perspective, it's important to remember that any potential talent you want to hook is swimming through a sea of offers. If your onboarding package isn't substantial enough, you'll risk losing top talent to a bigger, better offer. A new hire wants to feel like they're joining the company fully and wholeheartedly—offering equity incentivizes them to join the team and lets them know you're hitching your wagon to their horse. By providing equity, a company demonstrates that they want their new hire to succeed as much as they want the business to succeed.

Employees who feel valued and rewarded for their hard work are less likely to walk away

Employee turnover will decrease when employees have something that will accrue the longer they stay: it's a waiting game, and you'll reap the rewards. If you stay for your four-year vesting period, the better your work, the better your rewards.

Building a culture of rewarding success will ultimately create a happier work environment.

People love to know that they've done an excellent job, and even more, they love to be rewarded for doing a good job. Equity makes it easier for employers to show appreciation for their team's hard work.

Equity builds a foundation of ownership and incentivizes loyalty.

Incentivizing employees to work towards making the company succeed creates alignment between employees and management. If workers own a piece of the company, they will work harder to make the company better, as that is also working towards their investment and future.

It ultimately comes down to understanding your worth and your employees' worth. Equity equates to worth, both for the employer and the employee. Making sure everyone has equity goes a long way toward ensuring that people feel fairly compensated and happy in their positions. It may even be the deciding factor in an employee staying instead of leaving the company.

It ultimately comes down to understanding your worth and your employees' worth. Making sure everyone has equity goes a long way towards making sure that everyone is fairly compensated as well as happy in their positions. It may even be the deciding factor in an employee staying instead of leaving the company.

Equity is an essential piece of the VC-backed startup journey. Now that you’ve got a deeper sense of how options work, let’s ensure you’re on the right track regarding compensation. Check out our 2023 Compensation Guide to ensure you get what you’re worth!

For additional resources and to learn more, please visit our resource center.

What Now?