Seed-to-IPO Scale Guide

The Scale Series | Part 1

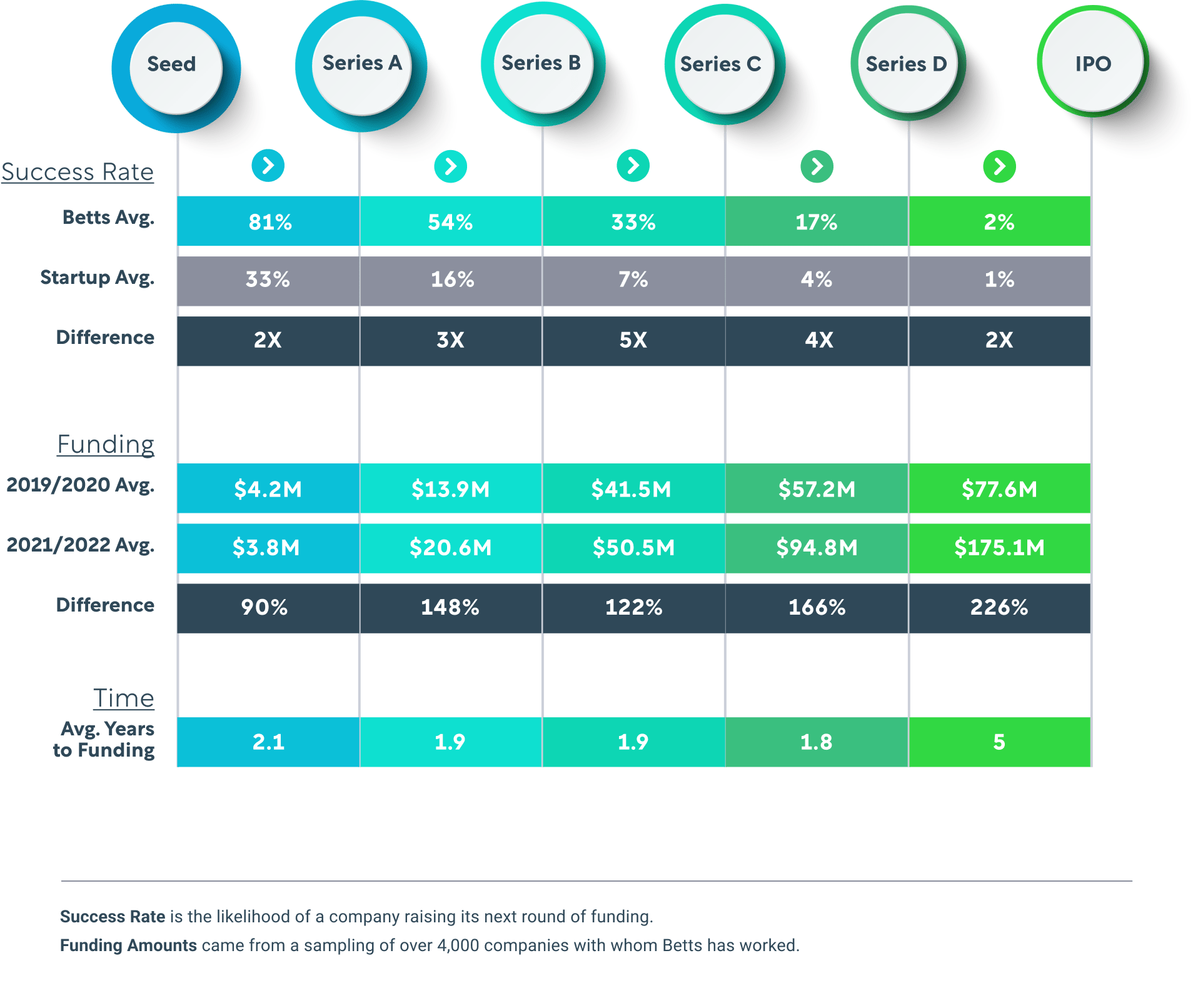

In this scale guide series, we use data from the thousands of companies we have worked with over the last five years, analyzing how their hiring practices impacted whether or not they got to their next round of funding. We explore what hiring should look like at each Series round, because scale means different things at different stages of the startup lifecycle.

Wherever you are in your startup journey, this guide offers data-driven insights into successful hiring practices gleaned from our two decades plus experience in tech. This data is especially relevant as companies that worked with Betts were 3X more likely to get to their next round of funding. We show you, at each funding stage, the hires companies that worked with Betts made versus other members of the startup community — the results are astonishing. In short, getting the right number of hires at the right time — with the right experience for the right cost — is the difference between growth and stagnation.

This guide details how the best startup companies in the world are scaling, hitting their targets, and getting to the next round of funding.

Here are the 6 parts of our scale series:

If you are a venture-backed company, you are trying to change the world while also getting to your next round of funding. Welcome to the first installment of a 6-part scale series that will explore best practices for successfully scaling your business.

The Startup Lifecycle

by the Numbers

Success Rate is the likelihood of a company raising its next round of funding.

Funding Amounts came from a sampling of over 4,000 companies with whom Betts has worked.

$41.5M

$50.5M

1.9

33%

7%

5X

122%

$4.2M

$3.8M

2.1

81%

33%

2X

90%

$13.9M

$20.6M

1.9

54%

16%

3X

148%

$57.2M

$94.8M

1.8

17%

4%

4X

166%

$77.6M

$175.1M

5

2%

1%

2X

226%

Success Rate

Betts Avg.

Startup Avg.

Difference

Funding

2019/2020 Avg.

2021/2022 Avg.

Difference

Avg. Years

to Funding

Time

Series A

Series D

Series C

IPO

Seed

Series B

Raising Your Next Round

Many venture-backed startups wonder: What are the average funding rounds? How long between funding stages? Here are some data-driven insights.

Scaling

Betts has worked with thousands of companies — almost all venture-backed at some point. We wanted to see if there was a correlation between hiring practices and getting to the next round of funding. Spoiler alert: there is! For example, on average, companies that did not get their next round of funding shared this trait: they had ½ to 4X fewer Sales, Marketing, and Customer Success hires than those who successfully raised their next rounds.

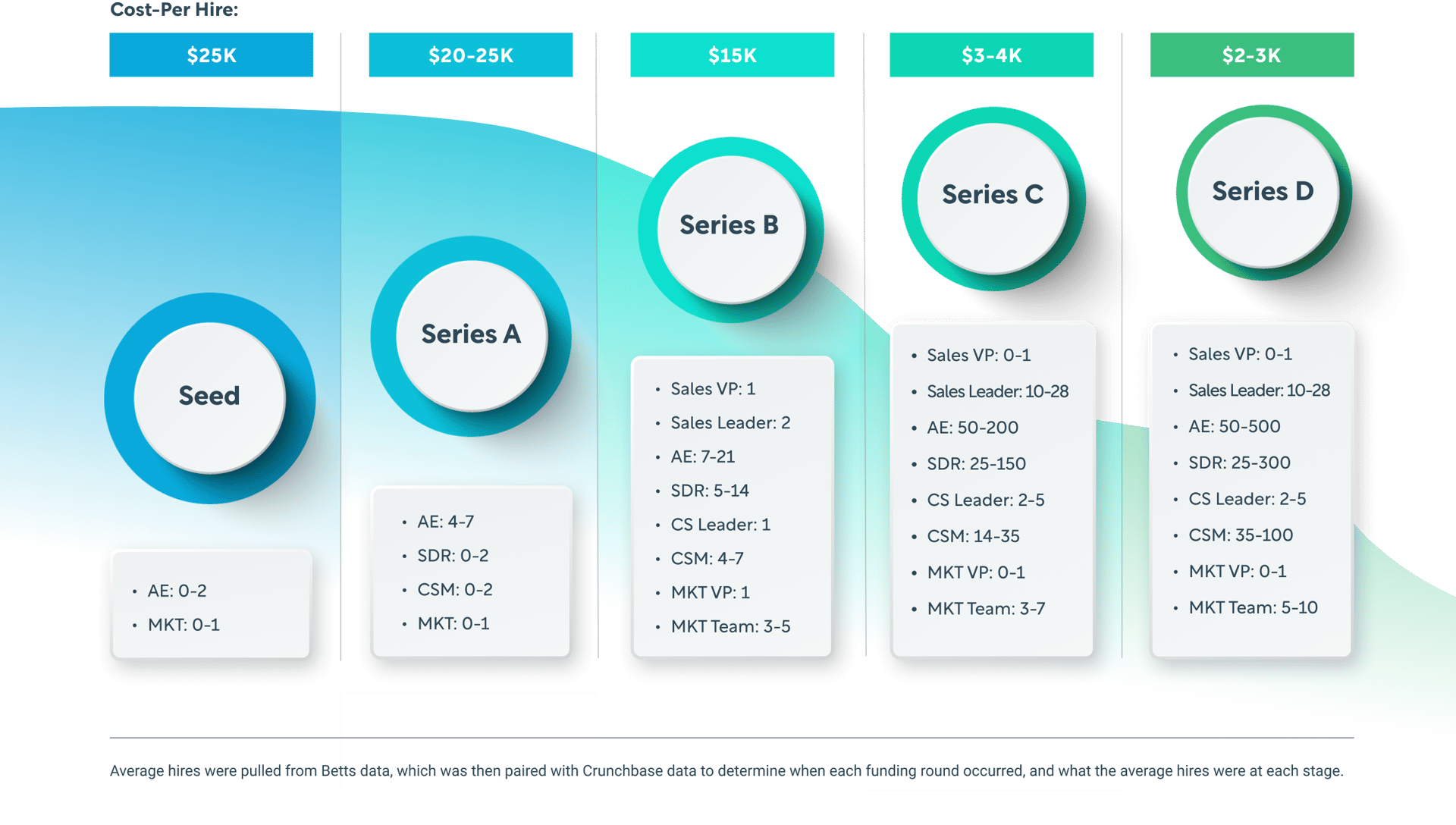

Every business segment is run by a North Star metric—cost-per-hire is THE grail for talent acquisition. Organizations must understand their cost-per-hire to build a strategic plan to meet their business goals. An inverse relationship exists between cost-per-hire and the number of hires needed to scale as companies move further down the startup lifecycle.

Key Hires Per Funding Round

The Series B to Series C transition is where we see the average cost-per-hire cut by 5-10X due to the sheer volume needed to hit scale.

Series A

Series B

Series C

Series D

Seed

- AE: 0-2

- MKT: 0-1

- AE: 4-7

- SDR: 0-2

- CSM: 0-2

- MKT: 0-1

- Sales VP: 1

- Sales Leader: 2

- AE: 7-21

- SDR: 5-14

- CS Leader: 1

- CSM: 4-7

- MKT VP: 1

- MKT Team: 3-5

- Sales VP: 0-1

- Sales Leader: 10-28

- AE: 50-200

- SDR: 25-150

- CS Leader: 2-5

- CSM: 14-35

- MKT VP: 0-1

- MKT Team: 3-7

- Sales VP: 0-1

- Sales Leader: 10-28

- AE: 50-500

- SDR: 25-300

- CS Leader: 2-5

- CSM: 35-100

- MKT VP: 0-1

- MKT Team: 5-10

Average hires were pulled from Betts data, which was then paired with Crunchbase data to determine when each funding round occurred, and what the average hires were at each stage.

$25k

$20-25K

$15K

$3-4K

$2-3K

Cost-Per-Hire:

The Seed Round is a business’ critical jump-off point, though the least exciting regarding Sales, Marketing, and Customer Success hiring because most companies are pre-revenue or just starting to generate revenue. An essential insight from our data is that companies that received their Series A funding started hiring their first Account Executive during the Seed Round, a key hire tasked with generating enough revenue to validate the company’s business concept.

What you’re looking for in an Account Exec:

- Strong tenure at previous companies

- Has been the first hire before—or close to it

- Demonstrated track record for new business development

- Organized, driven, a connector, willing to roll up their sleeves

- Has previously sold into your expected target market size

Timing is EVERYTHING in the Seed Round — so no hesitation! You want to find the right initial Sales and Marketing hires to ensure the best chance of raising your Series A funding. If your recruiter does not feel like a partner helping you scale, move on, and find someone who does — this is the time to use an agency.

Seed Round

Seed

Series A

81%

No Add’l

Funding

19%

- Sales VP: 0

- Sales Leader: 0

- CS Leader: 0

- MKT VP: 0

Leadership:

- AE: 0-2

- SDR: 0

- CSM: 0

- MKT Team: 0-1

Contributors:

- Sales VP: 0

- Sales Leader: 0

- CS Leader: 0

- MKT VP: 0

Leadership:

- AE: 0

- SDR: 0

- CSM: 0

- MKT Team: 0

Contributors:

Classic Seed Round Missteps

- Thinking your hires MUST have experience in your industry. As a technical founder or founder in general, YOU are the expert, and that is the ONE thing you can successfully impart to your Sales team — your deep industry knowledge.

- Not paying market rate for talent. Your business model must consider realistic talent acquisition costs, especially for strategic hires.

- Overpaying for a hire. The inverse of the above — know that more expensive does not necessarily mean better. There is a Goldilocks sweet spot for paying JUST the right amount for the talent you need.

- Not having a hiring process. From the beginning, ensure you work with recruiters to set a hiring process, including a scorecard. Be consistent with following this process once set — it allows for consistency and validation of quality hires.

- Prematurely bringing in a VP of Sales, Marketing, or Customer Success. These hires are costly, and to succeed, they will still need Sales Representatives and Account Executives to gain market traction, a process that can take a lot of time.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Dignissim nulla mi est nulla et ut cras. Adipiscing interdum facilisis sed leo.

Seed to Series A: Key Hires

Seed to Series A: Key Hires

Series A

The Series A hiring plan is also relatively simple, but this is where we see the IPO-bound companies pull away from the startup pack. These initial Account Executive, Sales Development Representative, and Customer Success hires are vital—they can make the difference in identifying your target market and developing your baseline revenue. Our data shows that Series A companies that did not get to the next round were often focused on hiring leadership roles over individual and Customer Success contributors.

After raising Series A funding, successful companies (read: those that make it to Series B and beyond) typically hire their first two to four Sales Representatives to begin building revenue. About six months to a year after that, they bring on their first Sales leader, who, in turn, hires another two to five Sales Reps, a couple of Sales Development Reps, and a couple of Customer Success Managers to ensure that they hit initial revenue targets.

To ensure hiring success, lean on an agency or outside resource to help set best practices for hiring, compensation, equity, and more. Spending the money for these first hires will pay off in spades because they will set you up to secure your Series B funding.

Series A

Series B

67%

- Sales VP: 0

- Sales Leader: 1

- CS Leader: 0

- MKT VP: 0

Leadership:

- AE: 4-7

- SDR: 0-2

- CSM: 0-2

- MKT Team: 0-1

Contributors:

- Sales VP: 0-1

- Sales Leader: 0

- CS Leader: 0

- MKT VP: 0-1

Leadership:

- AE: 0-2

- SDR: 0-2

- CSM: 0

- MKT Team: 0

Contributors:

No Add’l

Funding

33%

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Dignissim nulla mi est nulla et ut cras. Adipiscing interdum facilisis sed leo.

Classic Series A Missteps

- Hiring senior leadership too early. The biggest mistake we see is hiring a senior VP of Sales (CRO) or VP of Marketing (CMO) before the company fully understands the market and has finessed the product-market fit.

- Hiring a single Account Executive. Companies that excel hire in pairs early — this creates a collaborative environment and helps protect against attrition.

- Technical founders delay hiring. Too many technical founders get in their own way here, delaying hiring by months. Focus on filling the first two sales-driving roles — get them in quickly so they can start generating revenue STAT.

Series A to Series B: Key Hires

Series B is when you want to hone your product-market fit. With the average Series B funding round at $50M, it is also the time to build your Sales, Marketing, and Customer Success infrastructure. Focus on your executive hires for Sales, Marketing, and Customer Success — and then let them begin to build out their teams. Series B is also when you want to start assembling your lead gen engine.

What is the most significant difference between companies that made it to Series C and those that did not? The number of Account Executives, Sales Development Representatives, Customer Success Managers, and other marketing professionals hired. We saw an average of 2-3X the hires for these roles in companies that successfully raised their next round.

Look at it this way: If an average Account Executive is bringing in $500k per year in quota, you will need 7 to 20 Account Executives to hit your Annual Recurring Revenue or ARR target to demonstrate the growth that will get your greenlit to raise $100M in Series C funding.

NOW is the time to start scaling your internal recruitment team. See our Scale Matrix to understand how many team members you need to add.

Series B

- Not getting the right leaders. If you do not have a network of executives, hire an executive recruiter with expertise in your space. The right Sales, Marketing, and Customer Success hires are the difference between starting to scale and not. Companies who filled these critical roles were 2X as likely to make it to the next round of funding.

- Not focusing on retention. There is a correlation between companies that did not raise their next round and the size of their Customer Success teams. Once valued team members have come aboard, it is mission critical to focus on talent retention. Churn is burn — if you have a lot of it, it is akin to spinning your wheels — much action with little forward motion.

Classic Series B Missteps

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Dignissim nulla mi est nulla et ut cras. Adipiscing interdum facilisis sed leo.

Series B

Series C

51%

- Sales VP: 1

- Sales Leader: 2

- CS Leader: 1

- MKT VP: 1

Leadership:

- AE: 7-21

- SDR: 5-14

- CSM: 4-7

- MKT Team: 3-5

Contributors:

- Sales VP: 1

- Sales Leader: 1

- CS Leader: 1

- MKT VP: 1

Leadership:

- AE: 3-7

- SDR: 0-3

- CSM: 0-3

- MKT Team: 1-3

Contributors:

No Add’l

Funding

49%

Series B to Series C: Key Hires

Series C

Series C is ALL about scale. At this point in the startup game, you have demonstrated the right product-to-market fit and have curated a solid leadership team. Now, it is time to scale your talent exponentially to get to the next level.

Series C is a puzzle — you need ALL the right pieces to scale successfully. Without the right leaders, you will not attract the best Account Executive. And without the right Account Executives, the revenue will not materialize to keep those leaders engaged. At this point in the game, with an average of $95M raised — money is NOT the issue. Here’s what IS: knowing how to scale efficiently and effectively.

The companies who raised their series D funding had, on average, a minimum of 50 Account Executive hires, some upwards of 200 to 300. At this point in the startup game, scaling strategies often falter — companies either ramp up their internal recruiting teams to an unsustainable level that would not weather an economic downturn —or fail to add enough recruiters, and hence too few Account Executives, missing revenue targets. A Goldilocks balance can be challenging to get just right—keep at it.

By Series C, it is mission critical to have a full recruiting organizational component, but if they are armed only with LinkedIn Recruiter, it is like trying to fill a bucket with water using only a sieve.

Classic Series C Missteps

- Not having a sustainable hiring process. You need a sustainable way to add critical Sales, Marketing, and Customer Success team members.

- Hiring too many internal recruiters. Relying on too many recruiters will have you burning through cash.

- Lack of leadership development. Once you land the talent, it is essential to have a development protocol to cultivate leaders effectively.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Dignissim nulla mi est nulla et ut cras. Adipiscing interdum facilisis sed leo.

Series C

Series D

50%

- CRO: 0-1

- Sales Leader: 10-28

- CS Leader: 2-5

- CMO: 0-1

Leadership:

- AE: 50-200

- SDR: 25-150

- CSM: 14-35

- MKT Team: 3-7

Contributors:

- CRO: 0-1

- Sales Leader: 2-8

- CS Leader: 1-3

- CMO: 0-1

Leadership:

- AE: 10-50

- SDR: 10-50

- CSM: 7-23

- MKT Team: 3-5

Contributors:

No Add’l

Funding

50%

Series C to Series D: Key Hires

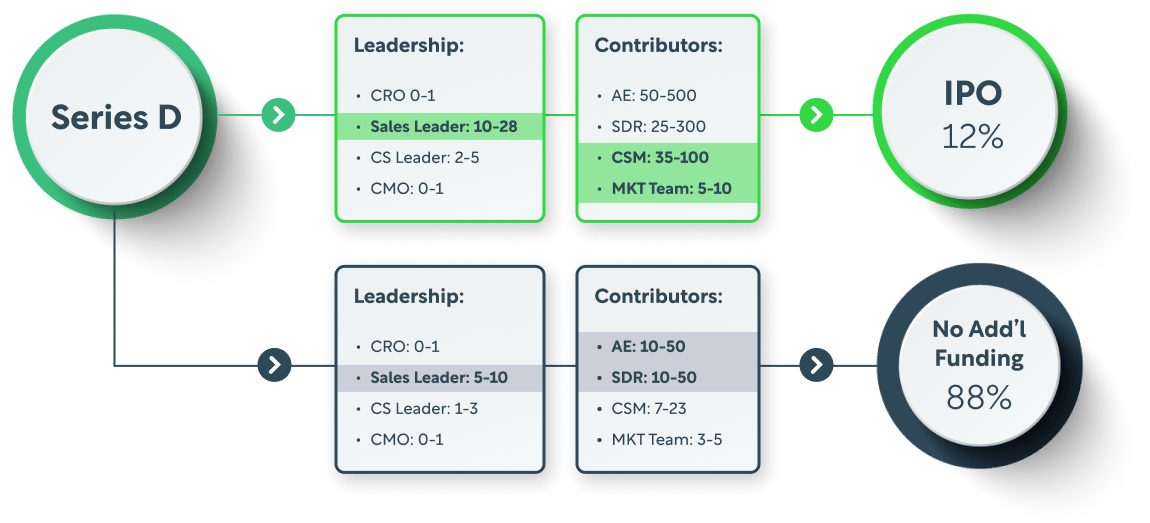

Series D

Let the scaling continue. About 50% of companies who raise Series D, put in new leadership with a different skill set, along with a true focus on the C-suite, CMO, CRO, etc. In Series D, we not only see a continuation of scaling AE’s and SDR’s, but a real ramp up in the CSM and marketing teams. We see the CSM teams start to catch up on annnual hiring goals, because at this point, you have hundreds, if not thousands of clients, and need to ensure you have high net retention. We also see widespread marketing growth, due to the fact that Series D companies are looking to become a household name.

With an average of $175M raised per Series D, you are in most likely in unicorn status. Continuing to find economies of scale, when scaling is vital. Your cost-per-hire should be somewhere are $2-3K per hire.

Only 12% of Series D companies make it to IPO, the majority get bought, or continue to raise. Only 2% of seed companies that Betts works with, make it from Seed to IPO. Though that is twice the national average.

Series D

IPO

12%

- CRO 0-1

- Sales Leader: 10-28

- CS Leader: 2-5

- CMO: 0-1

Leadership:

- CSM: 35-100

- MKT Team: 5-10

- AE: 50-500

- SDR: 25-300

Contributors:

- CRO: 0-1

- Sales Leader: 5-10

- CS Leader: 1-3

- CMO: 0-1

Leadership:

- AE: 10-50

- SDR: 10-50

- CSM: 7-23

- MKT Team: 3-5

Contributors:

No Add’l

Funding

88%

Classic Series D Missteps

- Not getting to a $2-3K cost-per-hire. The average cost per hire is estimated to be $10-15K for Series D companies. But when hiring nearly 500+ people in two years, you are looking at $5M in hiring costs versus $1M. While this may not seem like a large difference for a company with $175M in the bank, when you are in an aggressive growth mode, finding $4M in savings can be the difference between being profitable or not, IPO notwithstanding.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Dignissim nulla mi est nulla et ut cras. Adipiscing interdum facilisis sed leo.

Series D to IPO: Key Hires

More content from Betts:

Equity

Guide

Hot List

Guide

Betts CompensationGuide

Part 2: Scale Your Recruting Team

To learn more about how Betts can help you scale, chat with a team member today at bettsrecruiting.com/hire.

- Companies that work with Betts are 2-5 times more likely to raise their next round of funding. With Betts, organizations get the right hires at the right time—at a competitive cost-per-hire.

- Cost-per-hire is the north star metric every company needs to understand to scale successfully.

- Hiring the right leaders is one of the most important decisions a startup will ever make.

- Companies who continuously raise new funding rounds hire 2-3X the Sales, Marketing, and Customer Success folks—at the right time.

- Early on, one great hire can make all the difference. Later on, however, companies need to find a more efficient way to scale.